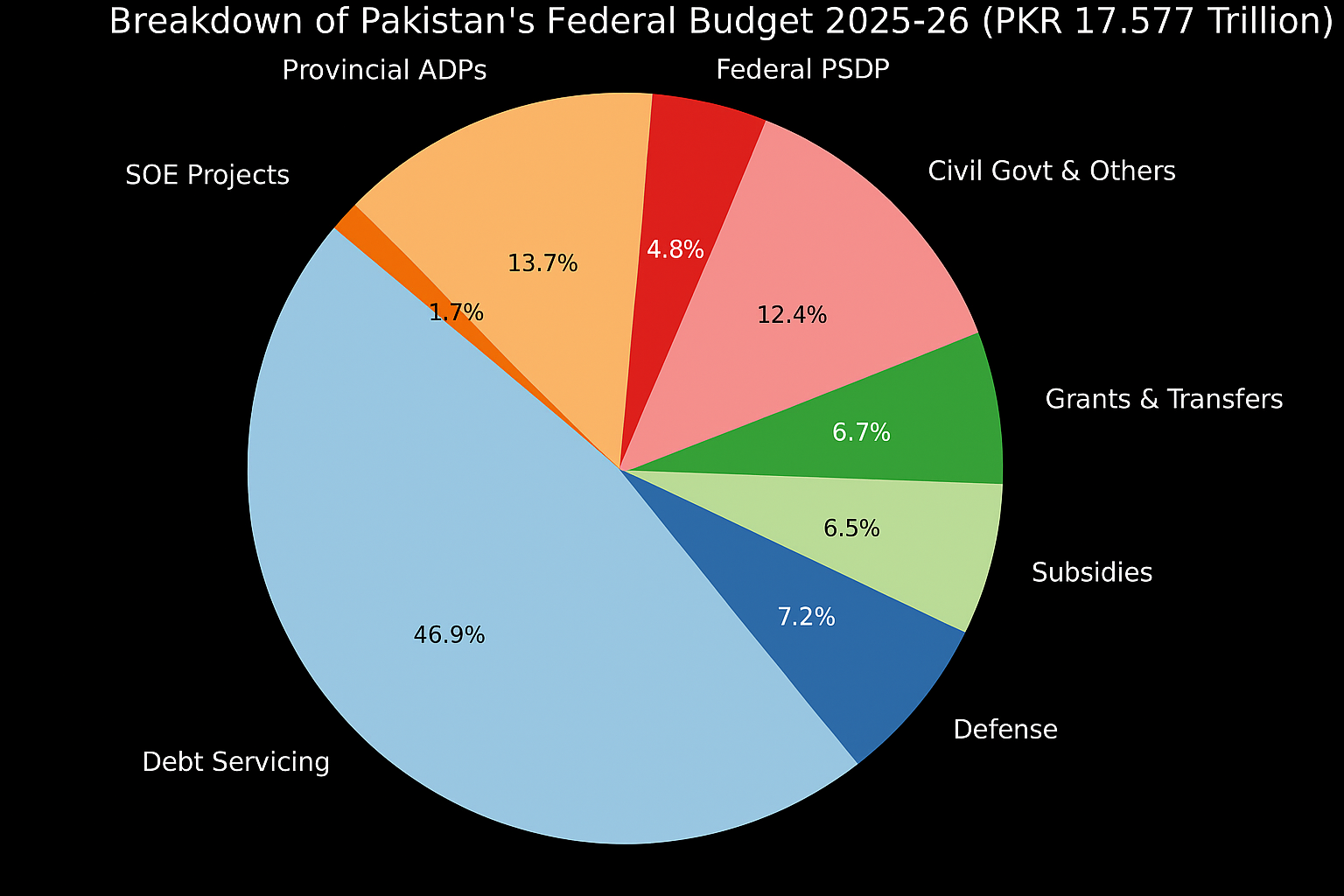

The Government of Pakistan has officially unveiled the much-anticipated Federal Budget 2025–26 with a total outlay of PKR 17.577 trillion, aiming to balance fiscal consolidation with targeted development. Presented on June 12, 2025, by the Finance Minister Muhammad Aurangzeb in the National Assembly, this budget comes at a critical juncture as Pakistan faces mounting debt obligations, inflationary pressures, and a renewed push for economic growth.

Key Budgetary Allocations:

A breakdown of the budget reveals the government’s core priorities:

-

Debt Servicing takes the largest share, a staggering 46.9%, equating to approximately PKR 8.25 trillion. This highlights the country’s urgent need to manage its debt burden and fulfill international financial obligations.

-

Defense Spending Pakistan boosts defence budget by 20% accounts for 7.2% of the budget (around PKR 2.5 trillion), ensuring continued investment in national security amidst regional tensions.

-

Subsidies Government reduce subsidies by 14% represent 6.5%, amounting to PKR 1.18 trillion, aimed at cushioning the impact of inflation on essential goods and energy. This reduction primarily targeted the power sector, with a 13% cut in allocations for power subsidies

-

Grants and Transfers take up 6.7%, primarily for social safety nets like the Benazir Income Support Programme (BISP) and provincial transfers.

-

Civil Government & Others receive 12.4%, covering administrative expenses and general governance.

-

Federal PSDP (Public Sector Development Programme) stands at 4.8%, while Provincial ADPs (Annual Development Programmes) claim 13.7% of the total outlay. as well The Power Sector Development Programme budget allocation is reduced from Rs105 billion to Rs90 billion — a reduction of 28%

-

SOE Projects (State-Owned Enterprises) are allocated 1.7%, reflecting efforts to reform struggling public sector entities.

Revenue Targets and Deficit

The Federal Board of Revenue (FBR) has been tasked with collecting the Tax PKR 14 trillion and 5 trillion in Non-Tax that is a sharp increase from the previous fiscal year. The government hopes to generate an overall revenue of PKR 13 trillion, largely through tax reforms and widening the tax net. Despite this, fiscal deficit is 3.9% . Government also imposed 18% tax on digital creators like free lancers, youtubers, tik tokers and other social media users.

To bridge the gap, the government has proposed a Petroleum Development Levy (PDL) target of PKR 1.2 trillion, indicating that fuel prices may be adjusted accordingly.

Tax Measures and Reliefs

In an effort to balance tax collection with public relief, the government has introduced the following measures:

-

New income tax slabs, with relief for the salaried class and low-income earners.

-

Higher General Sales Tax (GST) on luxury and imported non-essential goods.

-

Incentives for IT exports, freelancers, and small digital businesses to promote tech growth.

-

No new taxes on basic food items, medicines, or agricultural inputs, aiming to shield the poor from inflation.

Sectoral Priorities

The 2025–26 budget sets a developmental tone by prioritizing the following:

-

Energy Sector: Investments in renewable energy, infrastructure upgrades, and reduction of circular debt.

-

Digital Economy: Special incentives for startups, fintech, and e-commerce.

-

Climate Resilience: Allocation for disaster management, clean water access, and tree plantation drives.

-

Education & Health: A combined allocation of over PKR 410 billion reflects moderate progress in human development priorities.

-

finance-miniter-of-pakistan-md-aurangzeb

Growth & Inflation Outlook

previous year the government has set a GDP growth target of 3.6% but posting a figure of 2.7%, revealed the Economic Survey 2024-25, unveiled by Finance Minister Muhammad Aurangzeb on Monday These figures reflect cautious optimism amidst a challenging global and domestic economic environment. now the government has projected 4.2% economic growth in 2025-26, saying it has steadied the economy, which looked at risk of defaulting on its debts.

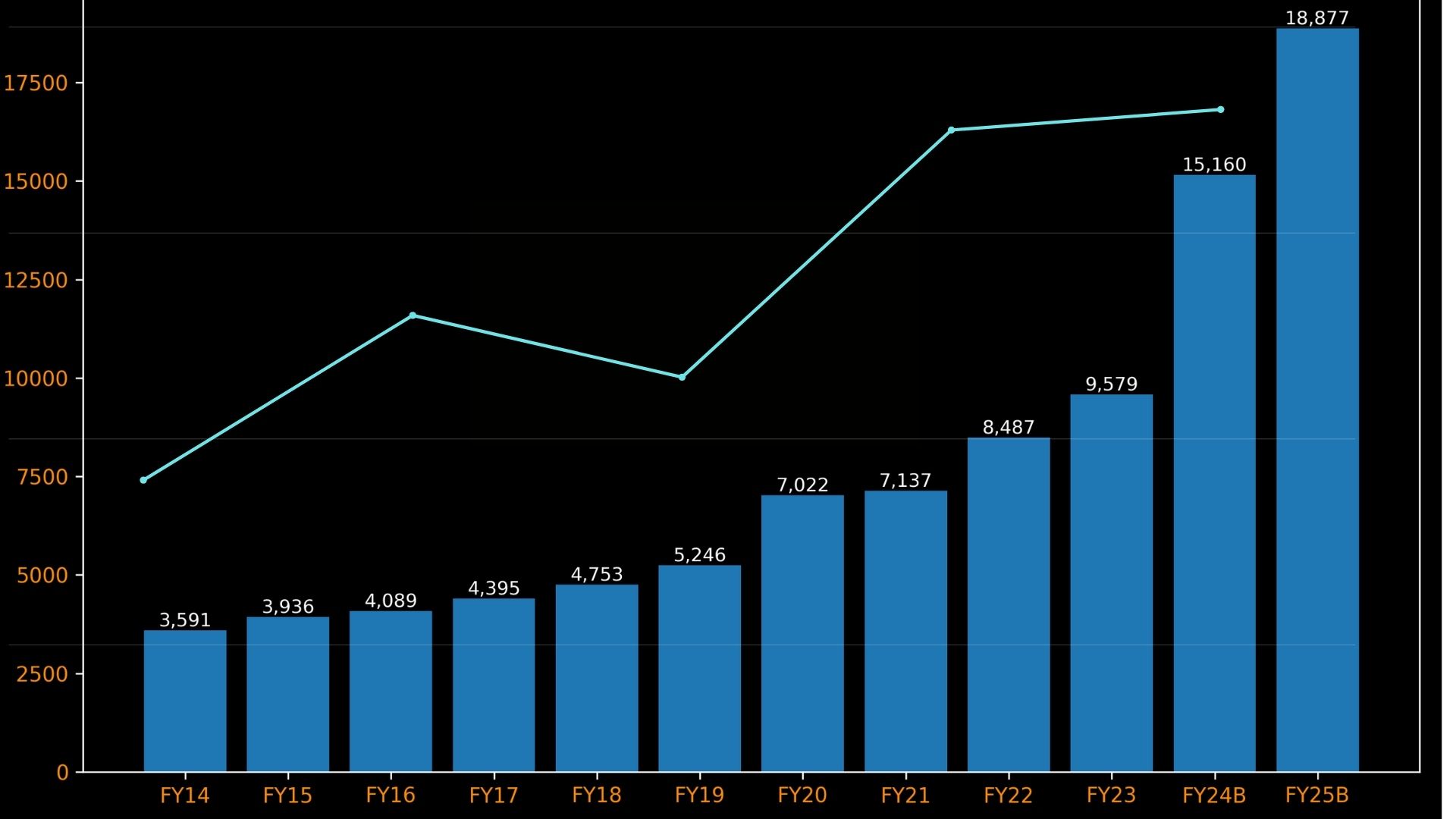

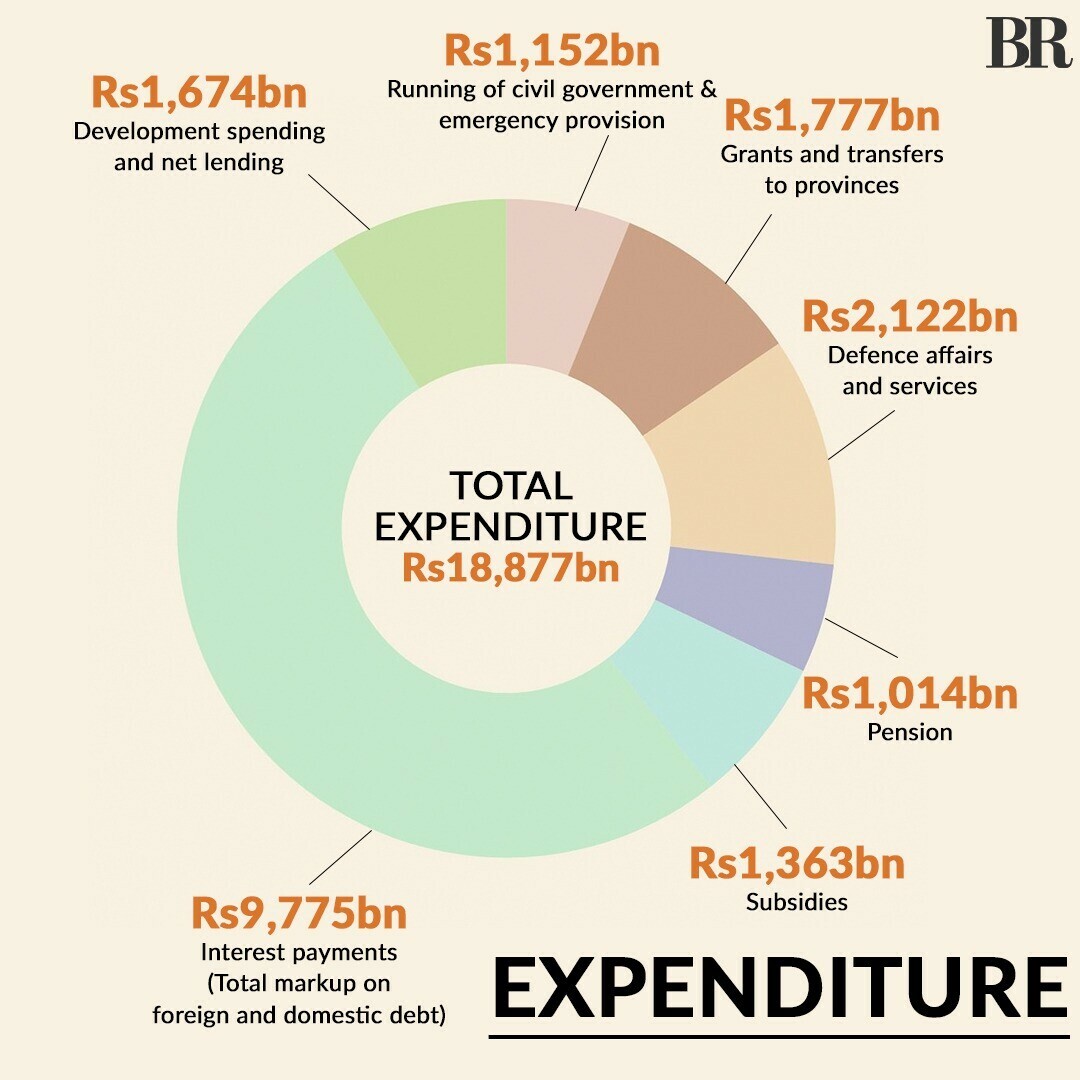

Review of Previous FY Budget 2024-25:

PKR 9,975 billion – Interest Payments

PKR 2,122 billion – Defense Spending

PKR 1,152 billion – Government Operations & Emergency Funds

PKR 1,674 billion – Development & Net Lending

PKR 1,777 billion – Grants & Provincial Transfers

PKR 1,014 billion – Pensions

PKR 1,363 billion – Subsidies

Conclusion

The Federal Budget 2025–26 represents a cautious yet ambitious attempt by the Government of Pakistan to stabilize the economy, reduce the fiscal deficit, and set a roadmap for sustainable growth. With a total outlay of PKR 17.577 trillion, this budget reflects the challenges of balancing debt servicing, national security, and developmental priorities while facing limited fiscal space and external pressure.

Although defense and debt repayment continue to consume a major portion of expenditures, the government has made efforts to boost social safety nets, digitize the economy, and encourage clean energy investments. The reduction in subsidies, new tax measures on digital income, and the push for tax net expansion show a shift toward financial discipline.

With a targeted GDP growth of 4.2% and inflation control strategies, the budget carries cautious optimism. However, the effectiveness of this financial plan will ultimately depend on how well these measures are implemented, the global economic outlook, and Pakistan’s ability to maintain political and fiscal stability.

CTA:

Stay informed with Muav PK as we continue to uncover the truth behind breaking headlines, military developments, and geopolitical shifts in South Asia.

🔔 Subscribe to our blog for verified, unbiased updates.

📲 Follow us on TwitterX http://muavpk.com, Instagram, and Facebook https://www.facebook.com/share/1AbLcQwDfj/

🗣️ Comment below with your thoughts — Do you believe the full truth has come out?

https://muavpk.com/pakistan-budget-2025-26-bold-step-for-public-relief/

Breaking News: Air India Flight AI171 Crashes in Ahmedabad : At Least 242 on Board

FAQs)

🔹 What is the total size of the Pakistan Budget 2025–26?

The total outlay of the budget is PKR 17.577 trillion, which is lower than last year’s budget of PKR 18.8 trillion.

🔹 Who presented the Pakistan Budget 2025–26?

The budget was presented by Finance Minister Muhammad Aurangzeb on June 12, 2025, in the National Assembly.

🔹 What is the largest allocation in the budget?

Debt servicing is the largest component, consuming PKR 8.25 trillion or 46.9% of the total budget.

🔹 How much has been allocated to defense?

PKR 2.5 trillion has been allocated for defense, which is a 20% increase compared to the previous year.

🔹 Are there any new taxes on freelancers and digital creators?

Yes, a new 18% tax has been imposed on digital content creators including freelancers, YouTubers, TikTokers, and other social media earners.

2 thoughts on “Pakistan Budget 2025–26 Reality: This is How People Will be Drastically Affected / The Alarming Truth for Pakistanis”