Explore the key highlights of Pakistan’s Federal Budget 2025–26, including economic targets, sector-wise allocations, tax reforms, and what it means for citizens and businesses. and how it will impacts on public , and as well for defense .

The Federal Budget for the fiscal year 2025–26 has been officially presented by the Government of Pakistan and will announce on 10 of june 2025, outlining ambitious economic reforms and a roadmap for sustainable growth. Amid challenging global economic conditions and domestic fiscal pressures, the government aims to stabilize the economy, broaden the tax base, and increase development spending.

Highlighting the Key Points of Pakistan Budget 2025–26:

Budget Size and Targets:

-

Total Budget Outlay: PKR 18 trillion or 64.75 billion US$ (approx.)

-

GDP Growth Target: 3.7%

-

Inflation Target: 12%

-

Fiscal Deficit Target: 5.9% of GDP

-

Revenue Collection Target (FBR): PKR 12.5 trillion

Sector-Wise Allocations:

-

Defense: PKR 2.1 trillion , pakistan has allocate 2.1 trillion PKR or 7.55 billion US$ for their defense , recently pakistan have been dealing with china on J35 aircrafts and PL-21 missiles and some other missiles systems which are not officially announced .

pakistan army -

Education: PKR 790 billions are allocate for education which is almost 7 times higher then previous year (2024-25) education budget the previous education budget was 103 billion PKR now 790 billion PKR , which is great initiative .

-

Health: PKR 600 billion, the budget is expected to include new tax measures potentially worth up to PKR 600 billionPublic Sector Development Program (PSDP): PKR 1.5 trillion

-

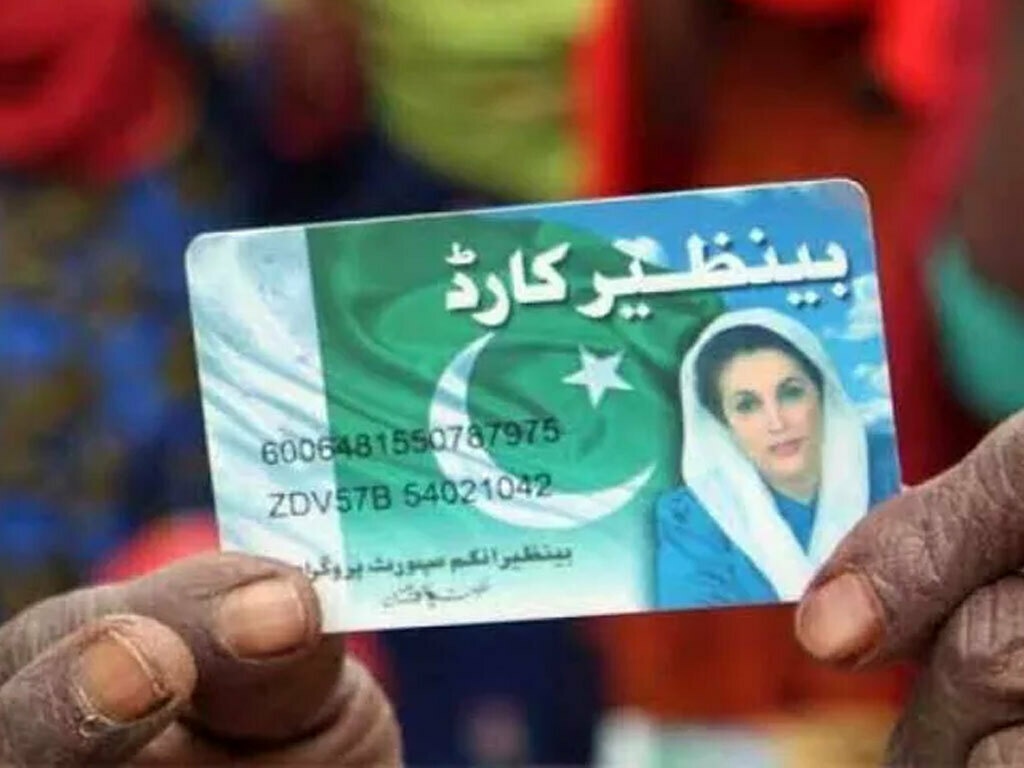

Subsidies & Social Protection (BISP, Utility Stores, etc.): PKR 1.2 trillion,

BISP the news report says that the citing officials from the Finance Division, the quarterly payment under BISP is expected to increase from Rs13,500 to Rs14,500 starting January 2026. This funding will also allow BISP to sustain the enrollment of 10 million households. The increased allocation will also enable an uplift in the Unconditional Cash Transfer (UCT) Kafaalat benefits to adjust for anticipated inflation in 2025.

Taxation & Reforms:

-

there is No new taxes on the salaried class . SCAP urged the government to reinstate tax credits for the salaried class and widen the tax net to include untaxed sectors

-

Increased tax on luxury imports and non-filers In the upcoming Pakistan budget for 2025-26, the government plans to increase taxes on luxury imports and potentially non-filers. Specifically, the government intends to expand the list of luxury items subject to a 25% sales tax on both imports and local sales, aiming to boost revenue and offset losses from potential reductions in other duties. Additionally, there may be changes to the tax structure for non-filers, potentially increasing their tax burden.

Luxury Imports:- The government plans to broaden the list of luxury items subject to a 25% sales tax.

- This includes items like home appliances, tiles, wallpapers, high-end wristwatches, and other goods.

- The measure is intended to offset revenue losses from potential reductions in customs duties and regulatory duties.

- The current 25% sales tax on luxury goods was introduced under SRO 297(I)/2023 and covers a wide range of items, according to Profit by Pakistan Today.

Non-Filers:- The budget may include changes to the tax structure for non-filers, potentially increasing their tax burden.

- This could involve higher registration fees, token taxes, and advance tax for those who do not file their income tax returns.

- The specific details of these changes are still being finalized, but the aim is to encourage broader tax participation.

Other Budgetary Measures:- The government is also exploring ways to attract investment and promote industrial development, potentially including reducing the cost of utilities and focusing on supporting industrial and manufacturing sectors.

- There are also discussions about bringing YouTubers and freelancers into the tax net.

-

Expansion of the tax net through digital integration , The Pakistan government plans to expand its tax base in the upcoming 2025-26 budget by bringing digital content creators, including YouTubers and freelancers, into the tax net. This initiative aims to generate an estimated PKR 500-600 billion in additional revenue for the fiscal year, according to a research report from Topline Securities. The pakistan government also proposes to implement a 3.5% tax on social media earnings platforms e.g YouTube and TikTok, and Facebook etc according to a report from Topline Securities.

-

Focus on documentation of the economy

Support for Key Sectors:

-

Agriculture Package: PKR 300 billion, including subsidized loans and fertilizers .

The federal gove

New varieties of rice being grown at the IRRI experiment station (upland area). rnment has planned to unveil a relief package for nine million small farmers in the upcoming federal budget for fiscal year 2025-26.

On the instructions of Prime Minister Shehbaz Sharif, a loan scheme will be introduced in the budget for small farmers with up to 12 acres of land. Furthermore, commercial banks will be engaged to provide loans to small farmers.

Sources said banks have prepared the scheme and briefed the Federal Finance Minister Muhammad Aurangzeb about it. The finance minister will brief the prime minister on the scheme for small farmers before it is made a part of the budget.

The sources added that a pilot project for the loan scheme would be launched in September this year while the conditions for the loans will be kept easy and simple.

Farmers owning less than 12 acres will be provided awareness about modern agriculture and access to machinery, which is included in the scheme’s framework.

pakistan economy is highly depend on agriculture sector , which is the 20% of total gdp of pakistan .

-

Exports Boost:

Incentives for textile, pharmaceutical, and manufacturing industries ,The government of pakistan aims to boost and increased the exports by implementing incentives for the textile, pharmaceutical, and manufacturing industries in the upcoming budget of FY 2025-26. These incentives are designed to enhance competitiveness, stimulate economic growth, and reduce dependence on the International Monetary Fund (IMF). Specific proposals include energy tariff adjustments, reduced compliances, and streamlined processes.

pakistan-export. Elaboration:

-

Textile Industry:

Textile industry is one of the most important industry of pakistan economy which contribute 8.5% of total GDP of the country . and pakistan is the 8th largest textile exporter in the Asia . The Pakistan Textile Council (PTC) has submitted proposals to the government, including the reintroduction of Regionally Competitive Energy Tariff (RCET) for gas and electricity. The PTC also suggests abolishing the 0.25% EDF surcharge on export proceeds and streamlining regulations to reduce compliances.

-

Pharmaceutical Industry:

The budget is expected to address concerns raised by the pharmaceutical industry, aiming to improve their competitiveness and export potential.

-

Manufacturing Industry:

The government is also focused on supporting manufacturing industries through various incentives, such as reduced compliances and streamlined processes, as well as tariff adjustments and tax reforms, says the Ministry of Commerce.

-

Other Incentives:

The budget may include measures to reduce cross-subsidies, establish new industrial zones with one-window operations, and revise the minimum wage concept to promote fair wages.

-

Government Commitment:

The Federal Minister for Commerce has assured the textile sector of strong government support in the upcoming budget, aiming to boost exports and strengthen industrial growth.

-

Export Facilitation:The government of pakistan is also considering retaining the Export Facilitation Scheme (EFS) in the FY26 budget to support exporters.

-

Impact on Citizens:

-

Salaried individuals to benefit from no new taxes

-

Petrol prices may remain volatile depending on global markets

-

Social welfare schemes expanded, including more beneficiaries under BISP

-

Cost of living still a concern due to inflation, despite price control efforts

Challenges Ahead:

-

Achieving revenue targets amid a large informal economy

-

Managing foreign debt repayments

-

Ensuring transparency in development spending

-

Inflation control while boosting growth

Conclusion:

The Pakistan Budget 2025–26 outlines a strategic roadmap to boost and increased the economic stability, promote development, and protect vulnerable communities amid ongoing challenges. With a focus on revenue generation, social protection, and sectoral reforms, this budget aims to strike a balance between fiscal responsibility and growth. Whether you’re a taxpayer, business owner, or citizen, understanding these changes is vital for financial planning and policy awareness. Stay connected with Muav PK for expert analysis, authentic news, and timely updates on Pakistan’s economic journey.

https://muavpk.com/pakistans-economic-comeback-2025-gdp-crosses-400-billion-per-capita-income-rises/

https://muavpk.com/imran-khans-latest-political-developments-may-2025/

https://muavpk.com/pakistan-budget-2025-26/

CTA:

Stay informed with Muav PK for accurate and timely analysis of Pakistan’s economic and political developments. Subscribe to our blog and follow us on social media for regular updates.

https://www.facebook.com/share/1AbLcQwDfj/

FAQs:

Q1: Who presented the Pakistan Budget 2025–26?

Finance Minister Muhammad Aurangzeb presented the federal budget in the National Assembly.

Q2: Is there any relief for the middle class?

Yes, no new taxes have been imposed on the salaried class, and subsidies have been increased for essential goods.

Q3: How will this budget affect inflation?

While inflation remains a concern, the government has targeted 12% and introduced measures to stabilize prices.

Q4: What is the government’s growth target for 2025–26?

The GDP growth target is set at 3.7%, supported by reforms and development spending.

5 thoughts on “A bold Budget of Pakistan 2025-26: Public Impacts”